How Can People Subcribe To My Blog On Squarespace

Open B9 Account in minutes

No credit checks

No minimum balance

Fully online

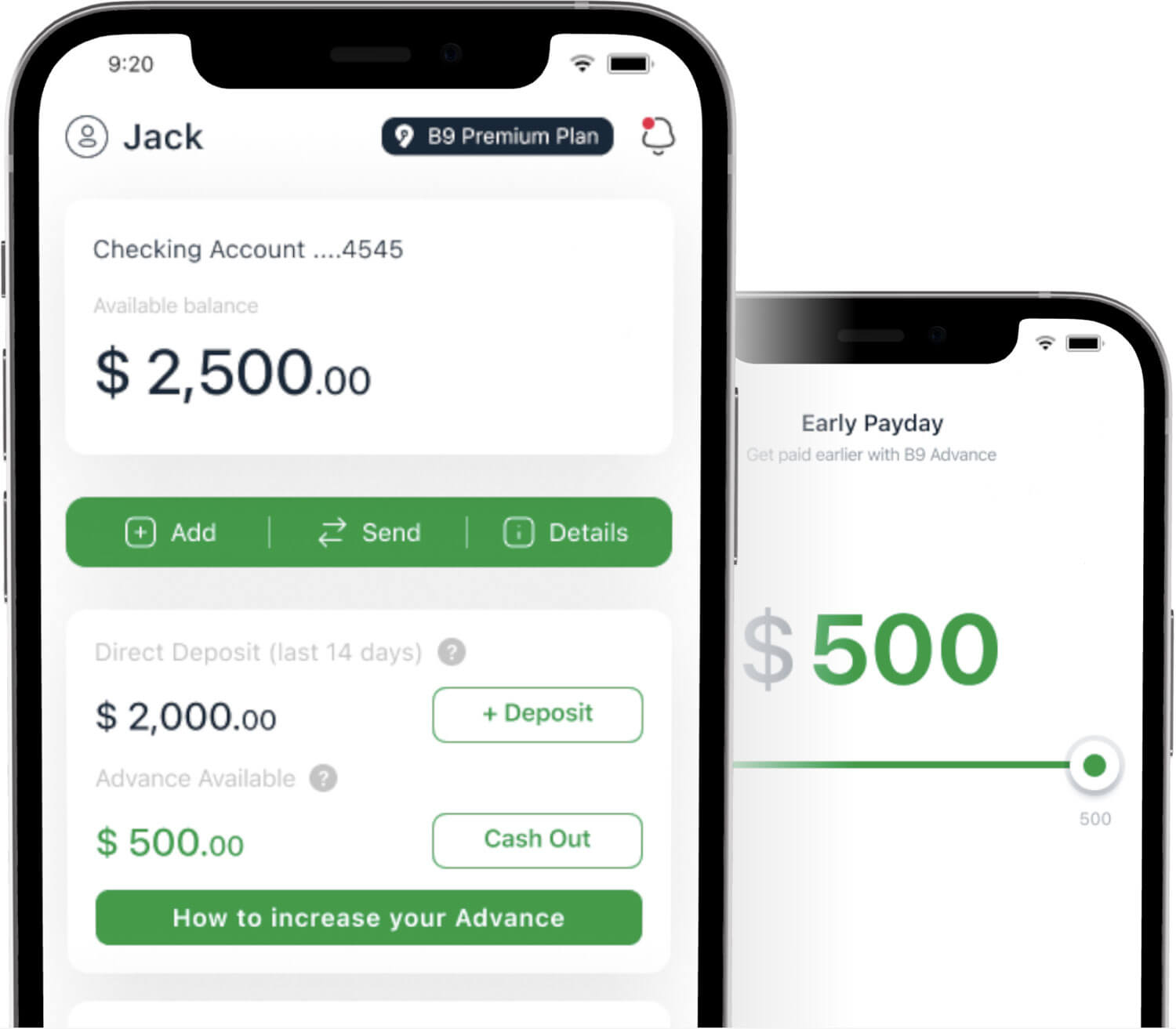

Everyday banking with B9 Mobile App

B9 Visa® Card

Pay everywhere with B9 Visa® Card or withdrawn cash from ATM

B9 Advance

Get your paycheck up to 15 days early

Fee Free bank transfers

ACH and internal transfers fee fee for B9 Members

Easy to apply,

Easy to use

Both SSN or ITIN are accepted in order to open your B9 account. You can easily connect B9 to any payroll platform to set up your direct deposit with B9.

There is a small $4.99 a month subscription fee for a B9 account which includes a B9 Visa debit card. Open your online bank account in 5 minutes with no minimum balance required, Start making purchases online with your B9 virtual card which is assigned instantly. No overdraft fees, no minimum balance required. Get your B9 debit card now.

GET YOUR B9 VISA® DEBIT CARD

Everyday banking with

NO credit checks,

NO minimum balance,

NO overdraft fees.

![]()

Only need

SSN or ITIN!

SSN & ITIN are accepted to open B9 Account.

![]()

Instant

cash

Instant transfers between B9 members.

![]()

B9 Visa®

Card

Pay everywhere with your B9 Visa® Card or withdraw cash from ATM.

Janaya Andrews

I love the app so much it makes everything fast and easy to get to and when your low on funds this app really does help with that problem a lot I know that this app helps me so hey why don't you go ahead and download this app for your next payday

Bean

Also I'm going to everything that I need to do is keep one of the notifications of the V9 and abilities of the expectations of the remarkable institutions

Kevin Jackson

B9 is a great banking app. They give you early access To your direct deposits and they have pretty quick customer support. I have used them for a couple months and will continue to do so.

Rob G

I've had nothing but a positive experience with B9. Account set up with easy and Bank verification was less than a day. It took a week for my direct deposit to hit so that they could give me an advance but once they could verify the income it was a very simple process. I would recommend to anyone.

kurbside

B9 is grrrrreat i really like this service and thanks B9 your the coolest awsomest app ever thanks so much be safe guys and god bless america give B9 a try seriously its grrrrrrrrrrrrreat

Peter Davidson

At first I was Skeptical of this app. A lot of paycheck advancement app are Deceiving and hard to set up and are not 100% honest. B9 was actually simple and they kept there word on Everything they advertise.I got a paycheck advancement easy and quick without any fees. I would definitely recommend this app. My experience was great the only thing I would change would be that the app lets you transfer money to a debit card instantly. Plus Be compatible with Apple wallet and Apple Pay. Besides that the app is amazing and I will be using this app as my main go to when times are hard. Thank you Plus customer service it's very helpful and they respond quick. Hundred percent recommend this to anyone and everybody

Joe Hansbrough

Very easy to use customer service was really quick to fix the problem that I had will definitely be recommending this to my family and friends

Kayla Krauter

Amazing app, it's so easy to use! Customer service is always super quick to respond and resolve whatever needs their attention. I always know my money's safe when I bank with B9!

Brittnay Setting

B9 has been so helpful in the past recent weeks! Our family came into some rough patches and this app was the perfect way of advancing my own hard earned money and not charging me an arm and a leg to receive it sooner! I am so happy I signed up and will continue using it! the creator is the real GOAT!

ziplo loveee

I love b9 they're amazing my money came quick and they gave me and advance and gave me a fair time to pay it I'm in love and I highly recommend

Carmen Jenkins

B9's tools are some of the best in the business. The bank also offers a full-service online experience and a great mobile app. They also have excellent checking and savings accounts, with no monthly fees, and a large ATM network.

Angela Russell

B9 has come in clutch a lot of times B9 has helped me so much in times that were rough I appreciate this app so much

GENERAL FREQUENTLY ASKING QUESTIONS ABOUT BANKING AND ADVANCES

How do i add someone to my bank account?

This additional person is called a �secondary signer.� Unlike with the joint accounts, this type of deal is not equitable. In the first case, there are two owners of a card, and they are both responsible for it. In the second case, an added person can do everything as the owner, but he�s not legally accountable. If the cardholder wants to withdraw the second user from his card, he can do it without any permission or reason. In any way, there are situations when you might need a secondary signer. The best choice would be to add a relative, a spouse, or the closest friend. After choosing a person, you both would need to go to the bank and sign some forms. And, of course, your personal documents will be needed. Look for this information on the website of the bank or call them up.

What do i do if my bank account is negative?

I believe that most people have experienced this problem when you forget the balance of your bank account, buy something and suddenly find yourself with a negative account. So what to do in this situation? Firstly you have to stop using your account because otherwise, bank fees will only grow. The second step is to transfer money to the account to make it positive. Here you can use your savings account or bring cash to the bank. Also, it is worth talking to a bank manager because some banks wave fees for the first overdraft.

What happens to a bank account when someone dies?

The easiest situation is when the person that passed away ascribed a Payable on a Death person. This means that a bank account has its own beneficiary, which will have access to it after the death of its owner. In other cases, a will of a dead person will help his/her close ones to answer that question. When probate wasn�t created, then the inheritance, bank accounts included, will be divided by the law.

What can someone do with your bank account number and routing number?

In the era when almost everyone has a bank account, a lot of purchases and other financial operations involve a bank account number and routing number. Many people hesitate to give up this information because they are afraid that they can become victims of fraudsters. But the question is, what, in fact, can be done to you if someone gets access to this data? We can start with the good news, and it is almost impossible to hack your online banking service using this information. However, you can still lose money through unauthorized transfer or become a victim of ACH fraud because these operations could be easily done with your bank account number and routing number.

What happens when you close a bank account?

When a client closes its bank account, the bank itself would want to see a zero balance on it in order to escape any unnecessary complaints from the side of its customers. However, if you decide to close it before withdrawing all the money, then you can later take it back or transfer them. But in this case, the bank might subtract a certain amount of money from it for the continuing storage of your assets. Before closing your account, also check the conditions under which the bank will allow you to do it.

How to close a bank account without going to the bank?

To do this, you first require to make sure that it is ready to be closed. You require not only to pay off existing debts (if any) but also to transfer the available money to another account or withdraw cash. Also, do not forget about automatic payments that may be linked to this account (subscriptions to applications or services, payments for mobile communications, and so on); you should either cancel them or link to another account. After that, you can close it through your bank's app. Usually, a couple of clicks are enough. If you have any additional questions or difficulties, be sure to contact the support service via chat or by phone.

How to open an online bank account?

Luckily, modern technologies allow people to open accounts in the banks without leaving their houses. This is a convenient and smart solution that is now widely used by the majority of users. To open an account in some bank online, you are supposed to perform several steps. Firstly, choose the bank and download its application on your smartphone. Secondly, go into the app and look for the button that will have a meaning similar to �create a bank account.� Thirdly, you are expected to make a choice considering the account type you have an interest in. Then, you can fill in the empty spaces with the personal information needed for the identification. The last step is to deposit a certain sum of money on the newly created account (this is an official requirement for some of the banks).

How to find a bank by account number?

If you are trying to answer the question of how you can find the bank using your account number, the answer might not satisfy you. Unfortunately, an account number is hardly useful when it comes to identifying the bank where it was opened. To find out to which bank a certain bank account belongs, you should rather use a routing number. A routing number is the raw of digits, usually placed right before the account number. It helps to find out where the bank is located and to which financial institution the account belongs. Not to confuse these two types of numbers, you can use the following hint: check which number is a couple of digits longer. The shorter one is the one you are interested in.

How to transfer money to another bank account?

To transfer money to another bank account within the same bank, use a mobile app, third-party mobile payment, bank, or wire transfer in person, and so on. You will only have to fill in the information about the recipient and the amount that you want to transfer. In this case, it is very easy and fast to transfer money, and you will not even have to pay any fees for it because this operation does not require external resources. If you want to transfer money to another bank, the process is very similar, but it has some nuances since external resources are involved. In addition, such a transfer requires additional security measures, which increases the transfer time, and it can take up to five days.

How much money do i have in my bank account?

This process is now very easy. You don't even have to go to the bank branch to do this. Although, of course, you can do that. But the fastest way is to use a banking app. With its help, you can not only check your account but also transfer money at any time. There are also other options: Online banking is almost the same as the application, only every time you need to log in and enter your username and password. ATM � insert the card and select the required service Set up online alerts about your account status Call the bank, answer security questions and find out the necessary information

What happens if someone has your bank account number?

Just having your bank account number doesn�t give a person any rights on it. But in combination with your routing and driver�s license numbers, address, and other information, the person can pretty much do everything as you can. Make sure not to give this information out to those who are not trustworthy enough, and be cautious about frauds that can call you and start asking for personal data. Save your bank�s number on your phone so that you will not confuse it with others.

How to add a beneficiary to a bank account?

Some banks provide an opportunity to add beneficiaries to the bank account through a mobile app, but the most common way to do it is to visit the bank office personally. This process is quick and does not require any special documents from you. Your ID, data about the bank account, the contract concluded between you and the bank, personal information about the beneficiary. The beneficiary doesn�t need to visit the bank office in this case. Also, this procedure will legally bind transactions of your funds after the death to the beneficiary and make the probate process easier and faster.

Free download for iOS and Android

No extra apps needed to move your funds

Legal

Contacting B9 Customer Support

B9's Customer Success Team is here to help you when you need us!

For faster assistance, our FAQ has answers for our most frequently asked questions and is available to you 24/7.

In-App Support

Our Agents are available for B9 members via in-app support tab:

Mon-Fri: 5 AM to 9 PM Pacific Standard Time (8 AM to 12 AM Eastern Standard Time)

Sat-Sun: 6 AM to 6 PM Pacific Standard Time (9 AM to 9 PM Eastern Standard Time)

Email Us You may email us at support@bnine.com, one of our friendly Customer Success Team members will answer in 24-48 hours.

For additional support you may phone us by clicking on the FAQ for our hours of availability.

Complaints

Banking services are provided by Mbanq banking partners, Members FDIC. To report a complaint relating to banking services, email compliance@mbanq.com

- ✅ How to check linked social accounts on squarespace

- ✅ Open a bank account with B9!

- ✅ How to check linked social accounts on squarespace - Bnine

How to check linked gmail accounts

Pay everywhere with your B9 Visa® Card or withdraw cash from ATM.

How to check linked google accounts

Both SSN or ITIN are accepted in order to open your B9 account. You can easily connect B9 to any payroll platform to set up your direct deposit with B9.

How to check list of ignored accounts on twitch

There is a small $9.99 a month subscription fee for a B9 account which includes a B9 Visa debit card. Open your online bank account in 5 minutes with no minimum balance required, Start making purchases online with your B9 virtual card which is assigned instantly.

How to check llinked accounts

No overdraft fees, no minimum balance required. Get your B9 debit card now.

More account check 6 links

How Can People Subcribe To My Blog On Squarespace

Source: https://bnine.com/account-check-6/how-to-check-linked-social-accounts-on-squarespace/

Posted by: vecchionothembeffe.blogspot.com

0 Response to "How Can People Subcribe To My Blog On Squarespace"

Post a Comment